Commercial building deep-energy retrofits provide substantially greater energy savings—often reducing a building’s energy consumption by up to 50 percent—than traditional retrofits. Yet they offer more than just a low utility bill. When planned and executed properly, a deep retrofit can yield improved employee health, productivity and satisfaction; bolstered sustainability leadership and reputation; access to tax, finance and entitlement subsidies; improved risk management; reductions in non-energy operating costs; and higher occupancies, tenant retention, rents and sales prices.

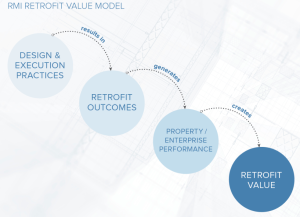

Building designers and managers who are able to articulate the full value of deep-energy retrofits to developers and owners deliver more value to their client; help the built environment reduce its carbon footprint; and can potentially drive greater investment in energy-efficiency retrofits by better articulating risks, lowering the hurdle for returns, and developing a more complete accounting and picture of those returns (which are often calculated on the basis of energy costs alone).

Nine Value Elements

Rocky Mountain Institute (RMI), which has locations in Snowmass and Boulder, Colo., has broken down the non-energy-cost aspects of deep-retrofit value into nine discrete elements that provide a comprehensive framework to capture all value beyond energy-cost savings:

1. Retrofit development costs are critical to calculating and presenting retrofit value because they represent the initial capital investment against which future cost savings and other benefits are measured. Though complicated to calculate, things that help offset those costs include pre-planned capital projects and access to tax credits, grants, rebates and other incentives.

2. Non-energy operating costs can be critical components of building profitability and company value. Deep retrofits can reduce these costs, which include maintenance, water, insurance and occupant churn rate. In some cases, a deep retrofit can also add more occupied space in a building through equipment downsizing. Adding more occupants to the building or subleasing the extra space reduces the net property operating cost per employee/occupant.

3. Retrofit risk mitigation is a traditional practice among developers and investors yet largely ignored by the current energy efficiency/sustainability retrofit industry. Clearly identifying risks and discussing how they will be managed will quickly elevate the capital request head-and-shoulders above the others, thus improving the likelihood of securing capital with a lower hurdle rate.

4. Health costs can be reduced because a deep retrofit often means improved health for building occupants through controlling moisture and pollutant sources, improved ventilation and access to outside air, more access to the natural environment and lighting, and improved temperature control.

5. Employee costs are rarely considered and can be quite substantial. A deep retrofit can reduce these costs by improving employee retention and lowering recruiting and employee-compensation costs.

6. Promotions and marketing costs often consume 10 percent of a company’s revenue. A deep retrofit can reduce these costs by improving a company’s reputation and bolstering marketing efforts.

1 Comment

Thank-you for creating, developing, contributing,and maintaining this great,useful website!!

I have been in the construction industry for 27 years, in roofing the last 20 yrs.

Being the largest volume Commercial contractor of the PremiumCoat high performance fabric reinforced elastomeric retrofit that is sustainable for the life of the building, I find it amazing to have unintentionally landed in the Commercial Deep Energy Retrofit business. As a retrofit…..we are making huge strides in the reduction of the carbon footprint, which changes the world, “One roof at a time” keeping the dinasouar petroleum based roofing out of the landfill.

As president of Smooth Finish Roofing and Waterproofing, I found it necessary to change our name and focus to that that reflected the energy retrofits of which our roofing system has become a enormous contributor. Sadly roofing is very often overlooked in the design and energy reduction strategy planning throughout the process. One flat roof building in North Oklahoma City is experiencing over 50% electricity savings during peak load in mid summer.

( 2010′ install)

In 2014 SEETco, Inc. was born; Sustainable Energy Efficient Technologies, Inc. to be more specific.

We are now approaching potential clients from the Energy front of which roofing contributes a large percentage.

For instance, if the roof alone achieves 20% – 30% energy savings of a 50% energy reduction project/goal…. that should be a significant consideration in the overall economic and environmental discussion.

Good job and Thanks again!

Respectfully,

Dennis Helm